Pay in Z was a platform initiative to expand Zip’s BNPL (buy now pay later) offering beyond its existing Pay in 4 and Pay in 8 plans, requiring alignment across product, design, risk, and engineering around both near-term delivery and long-term extensibility.

Zip’s fixed-plan BNPL model limited scalability and decision-making, creating the need for a more flexible approach to expanding plans without increasing product or operational complexity.

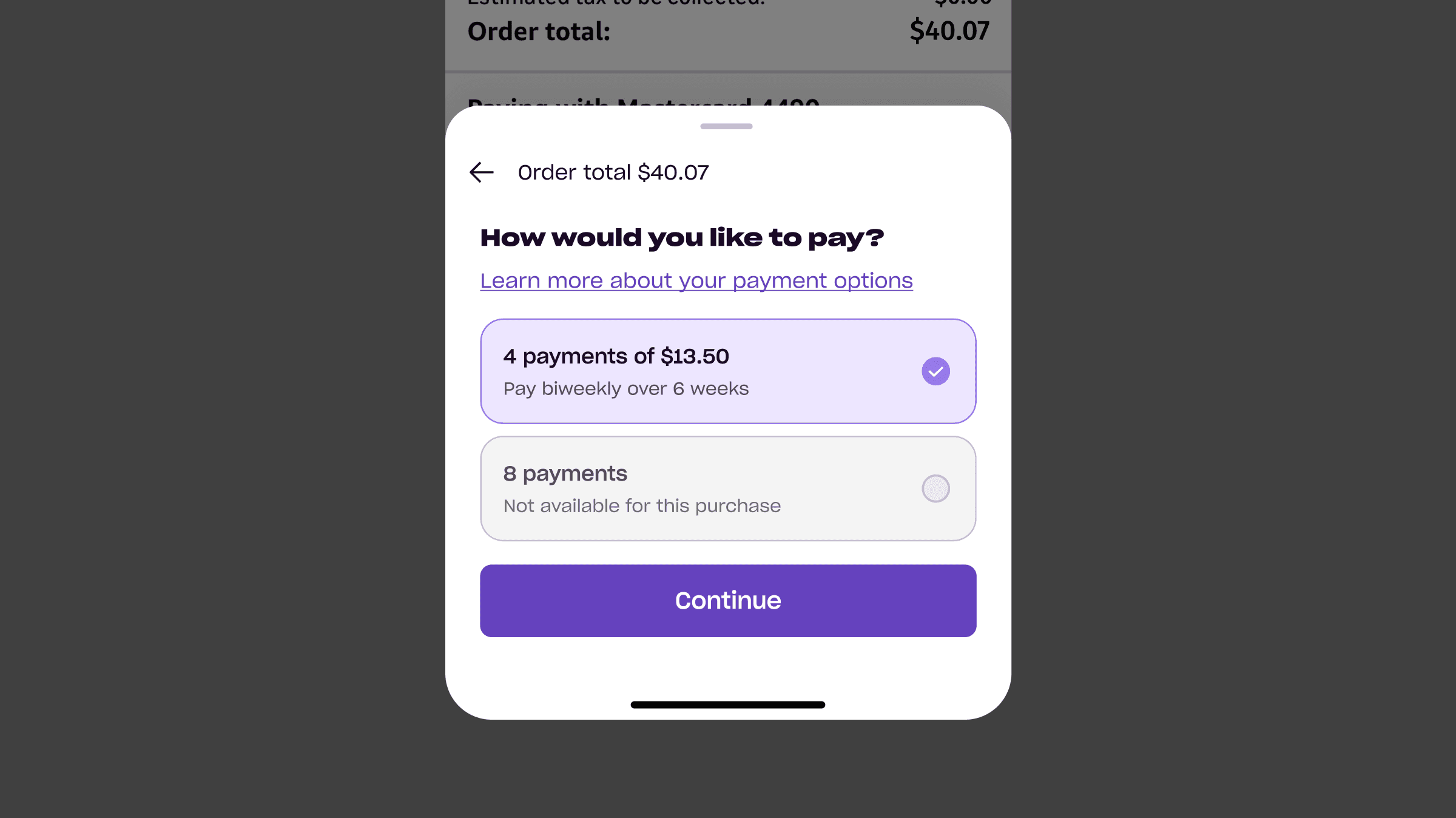

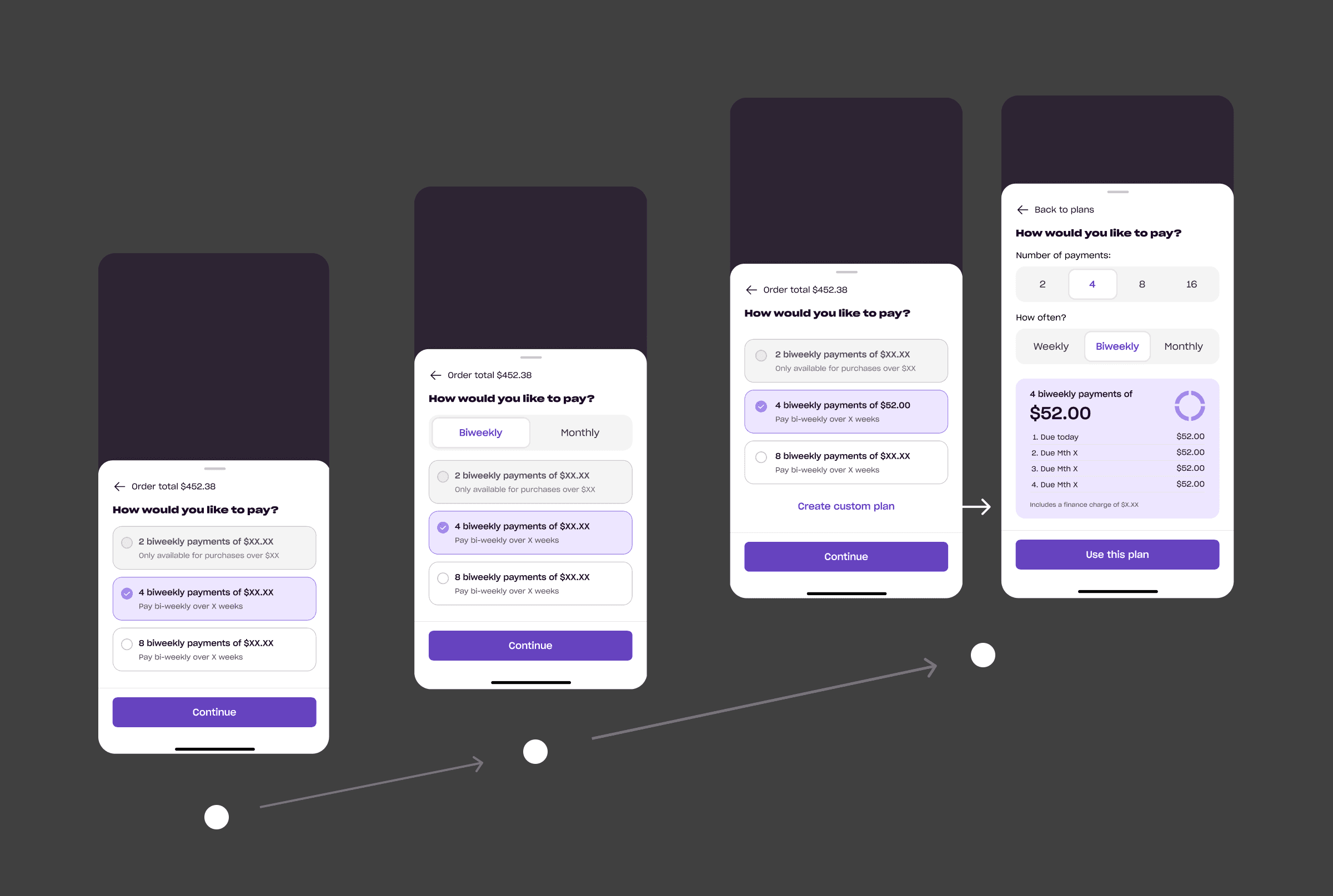

Original plan selection modal

In 2024 Pay in 8 was introduced to give Zip customers more payment flexibility (alongside Pay in 4). While overall successful, the launch highlighted several challenges for future plan launches.

Bespoke product and engineering work to configure and integrate Pay in 8 took 7 months to complete.

Product decision-making was constrained by current capabilities rather than future needs.

Impacts of product mix dilution was difficult to calculate and required a heavy test and learn approach.

At the same time, the business wanted to expand plan options to:

Reach new customer segments

Improve retention among existing users

Better manage risk and delinquency

The challenge was to expand responsibly - without fragmenting the product or increasing operational complexity.

Expanding beyond two plans provides more optionality to customers, while keeping up with competitors such as Affirm and Sezzle who offer more plan types.

The project had two parallel goals:

Design a scalable plan platform that could support many repayment structures over time.

Identify and launch the next plan in a way that balanced customer demand, risk, and business impact.

This work positioned the Pay in Z project as a strategic capability, not a one-off feature.

The project operated under several real-world constraints:

Existing production traffic and revenue could not be disrupted.

Risk policies and regulatory considerations limited viable plan structures.

Engineering systems were optimised for a small number of plans.

The initial launch needed to demonstrate value quickly.

These constraints required designing a solution that worked today, while deliberately creating room to evolve.

Discovery revealed that payment plans needed to be treated as a portfolio, not individual products, as customer preferences and risk outcomes aligned around simpler, shorter-duration plans.

A fragmented view of payment plans

Early discovery showed that teams were evaluating new payment plans in isolation. Each plan was discussed as its own product, which made it difficult to reason about trade-offs across customer value, risk, and long-term portfolio health.

This fragmented framing meant decisions were being made locally, without a shared view of how plans related to one another as a system.

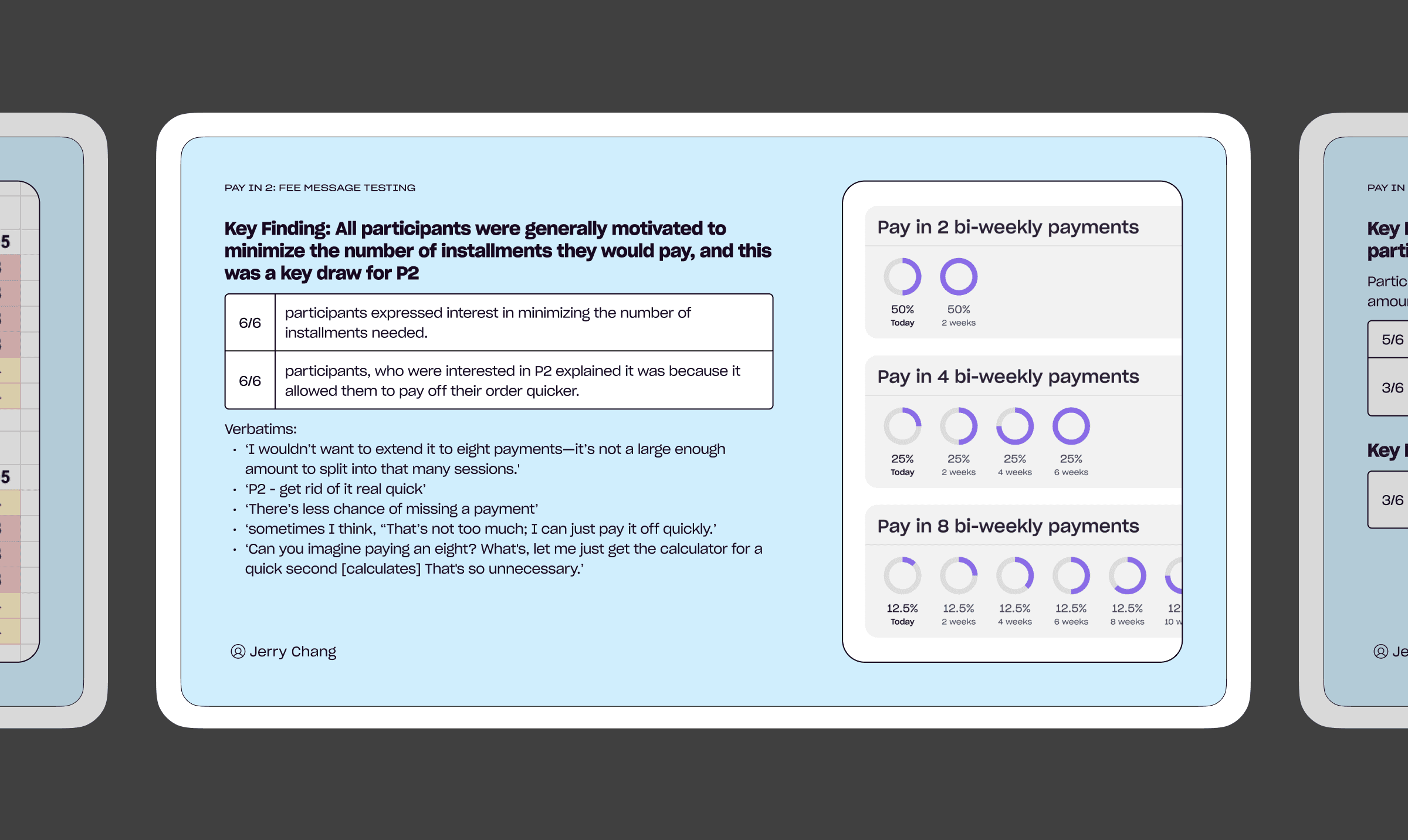

Customers valued simplicity over maximum flexibility

Research and behavioural data revealed that Zip’s highest-volume, long-tenured customers did not prioritise maximising affordability through longer payment schedules. Instead, they preferred shorter commitments with fewer repayments, even when larger purchases were available.

For these customers, simpler plans felt easier to understand, easier to manage, and more aligned with how they thought about short-term spending.

Risk and customer incentives were aligned

Risk analysis showed that shorter-duration plans were not only preferred by customers but also healthier for the business. They were associated with higher approval rates and lower delinquency, creating a rare alignment between customer experience and portfolio performance.

This challenged the assumption that longer plans were always the best growth lever.

Interviews and surveys revealed interest in shorter-duration plans.

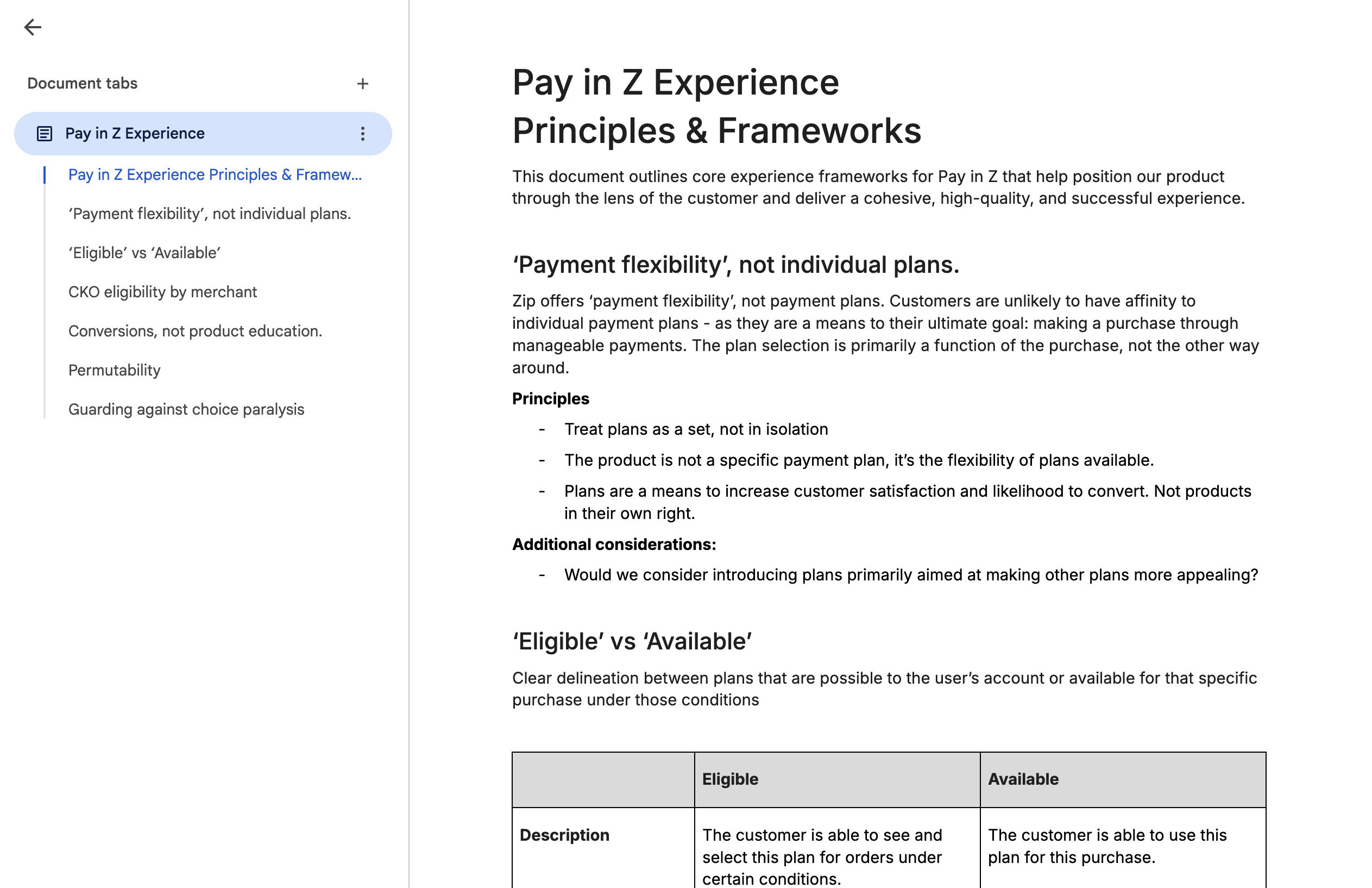

A scalable payment-plan platform

We designed a plan system decoupled from individual plan types, allowing Zip to operate payment plans as a configurable portfolio rather than a set of bespoke products.

This created:

A shared abstraction for repayment structure (frequency, duration, amount).

A UI that could support new plan variants without fragmentation.

Product principles that governed how plans were introduced over time.

Together, this turned plan expansion into a repeatable, governed capability rather than a series of redesigns.

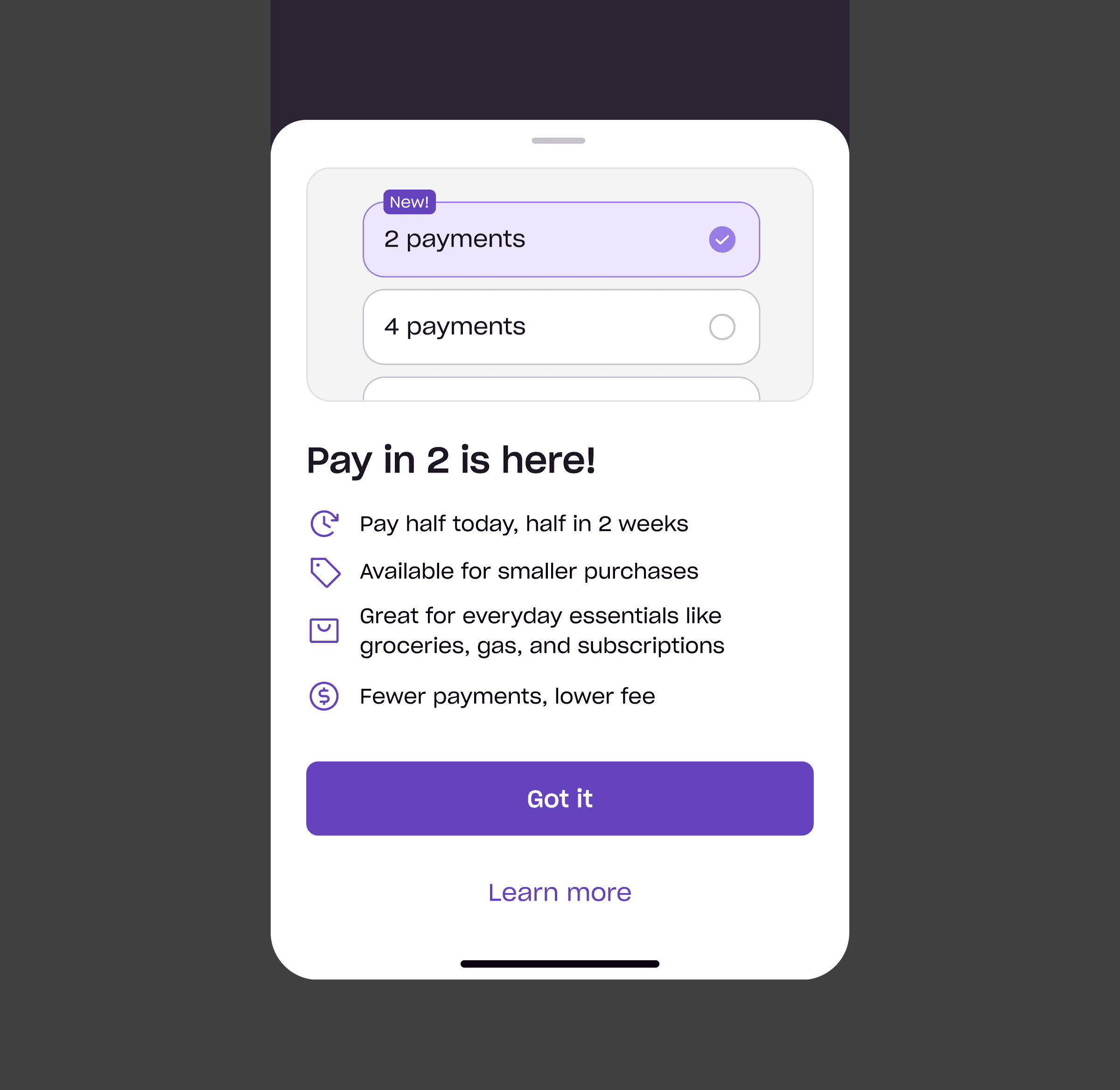

Pay in 2

Using customer insight and risk modelling, we selected Pay-in-2 (bi-weekly) as the next plan to launch.

Design and product decisions focused on:

Clear differentiation between plan options.

Minimising choice overload at checkout.

Aligning eligibility logic with risk tolerance.

This ensured the new plan delivered customer value without degrading portfolio health, validating both the platform and the underlying strategy.

In the background the Pay in Z initiative set up long-term value:

Laid the foundation for scalable plan expansion.

Ensuring eligibility logic aligned with risk tolerance.

Enabled release of Pay in 2 in response to validated customer demand.

Shifted internal thinking from 'adding plans' to building a plan platform.

While in the foreground, four months after launch Pay in 2 was delivering immediate value:

An NPS +63 mostly due to convenience and increased viability for smaller purchases.

Total Increase in TTV by 1.3% and 2.4% in total orders placed.

Just as importantly, the project aligned product, design, risk, and engineering around a shared long-term vision for payment plans.

This project reinforced several principles that continue to shape my work:

Platform thinking reduces long-term complexity.

Designing for today and tomorrow requires explicit trade-offs.

Goals across teams (such as customer demand and risk constraints) can align when explored collaboratively and strategically.

Product principles are essential when systems need to scale

Pay in Z reflects how I approach complex product problems: balancing immediate delivery with structural decisions that unlock future growth.