Led zero-to-one design of a spend management platform to extend Zip Business (the B2B lending arm of Zip Australia) from a point-in-time financing product into an ongoing financial operating tool for small and micro businesses.

The work was initiated through a launch partnership with Coles Group and focused on defining scalable platform primitives—organisation structure, virtual card management, and spend controls—delivered across multiple planned phases.

Phase 1 was delivered to launch-partner specifications. Zip Business however was shut down due to parent-company priorities, independent of the work delivered.

Delivering a scalable spend-management platform while meeting the needs for multi-user control, visibility, and in-store and online purchasing.

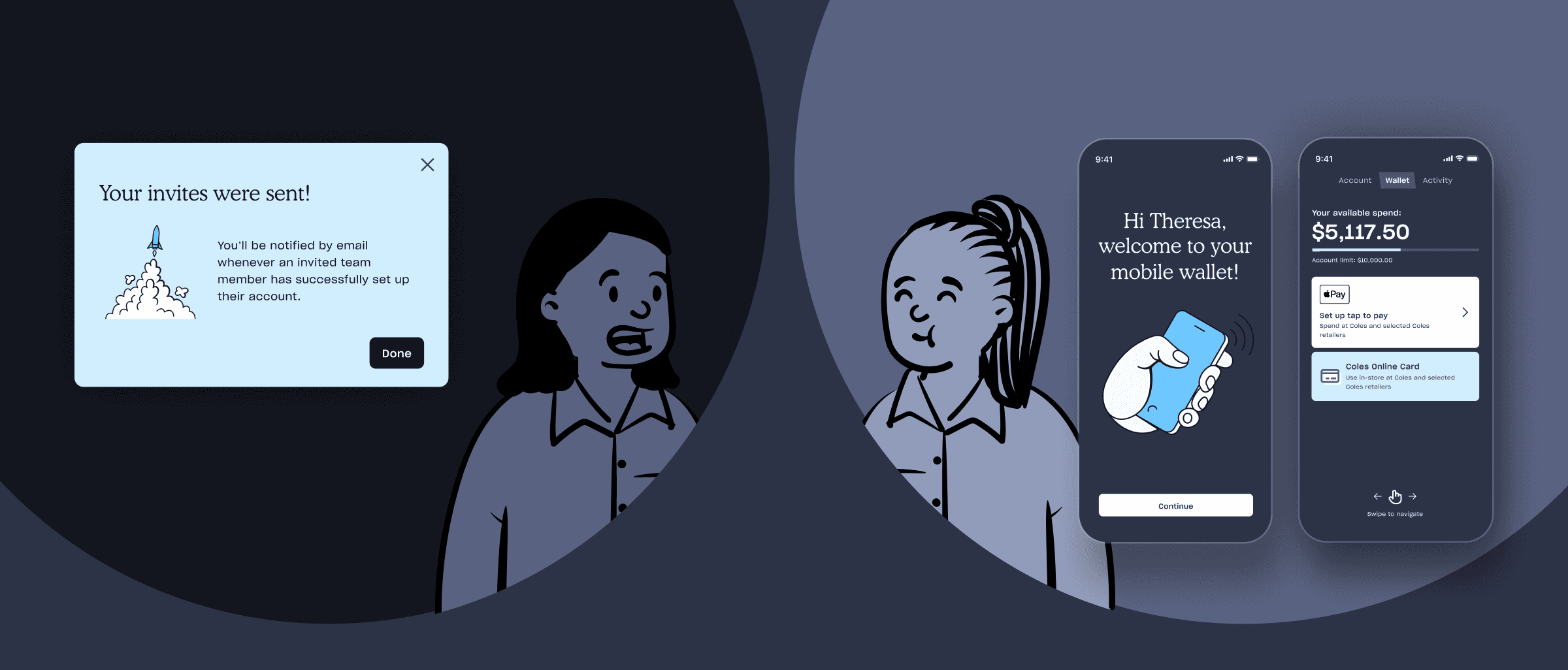

Zip Business app focussed on virtual card and repayments management.

Zip Business started out as a BNPL service for small businesses. Customers could sign up for credit ranging up to $150,000 AUD, make payments using a virtual card and either choose to repay with no fees within an interest-free period or defer payments for a fee.

While successful, Zip Business saw an opportunity to expand into a lean spend management product to support its customer base and synergize with its flexible financing capabilities.

At the same time, Coles Group - Australia's largest supermarket chain identified similar gaps in their existing business credit offering. While they provided credit accounts to some customers, they lacked:

Modern spend controls

Multi-user and organisational structures

Visibility into usage across teams

A scalable underwriting and management partner

The challenge was to design a platform that could:

Support enterprise-grade spend management needs.

Work for businesses ranging from small teams to large organisations.

Integrate with both in-store and online purchasing.

Be delivered incrementally, starting with a launch-partner use case.

A large launch partner and a maturing category created a rare window to accelerate Zip’s spend management strategy.

The opportunity combined direct customer demand, market momentum, and strategic leverage.

From a customer and partner perspective:

Coles Group was seeking a single solution to underwrite business credit accounts and provide spend management features

The required functionality closely matched Zip Business’s planned expansion into spend management

A Coles launch partnership offered immediate scale and credibility

From a market perspective, spend management was rapidly emerging as a core fintech category, with significant investment and acquisition activity, including:

Bill.com’s $2.5B acquisition of Divvy

Ramp’s $1.6B valuation

Significant raises from Airbase and Spendesk

From a business perspective, the opportunity represented:

3,000–10,000 potential business accounts

$100–200M AUD in annual total transaction value

140,000 Zip Business users, averaging ~3.5 members per business

Clear cross-sell potential into Zip’s consumer products

This positioned spend management not as an adjacent feature, but as a strategic growth pillar.

The project operated under several constraints:

A need to align with Coles Group’s launch timelines and requirements.

No existing spend management primitives within Zip Business.

A wide spectrum of customer maturity, from sole traders to multi-branch organisations.

The requirement to support omni-channel spend (in-store and online).

Incremental delivery without disrupting existing financing customers.

These constraints required a solution that was structurally sound from day one, but flexible enough to evolve without over-engineering.

SMBs wanted control and clarity, but only if it didn’t introduce operational overhead.

Discovery across internal teams, partner discussions, and customer research revealed consistent themes:

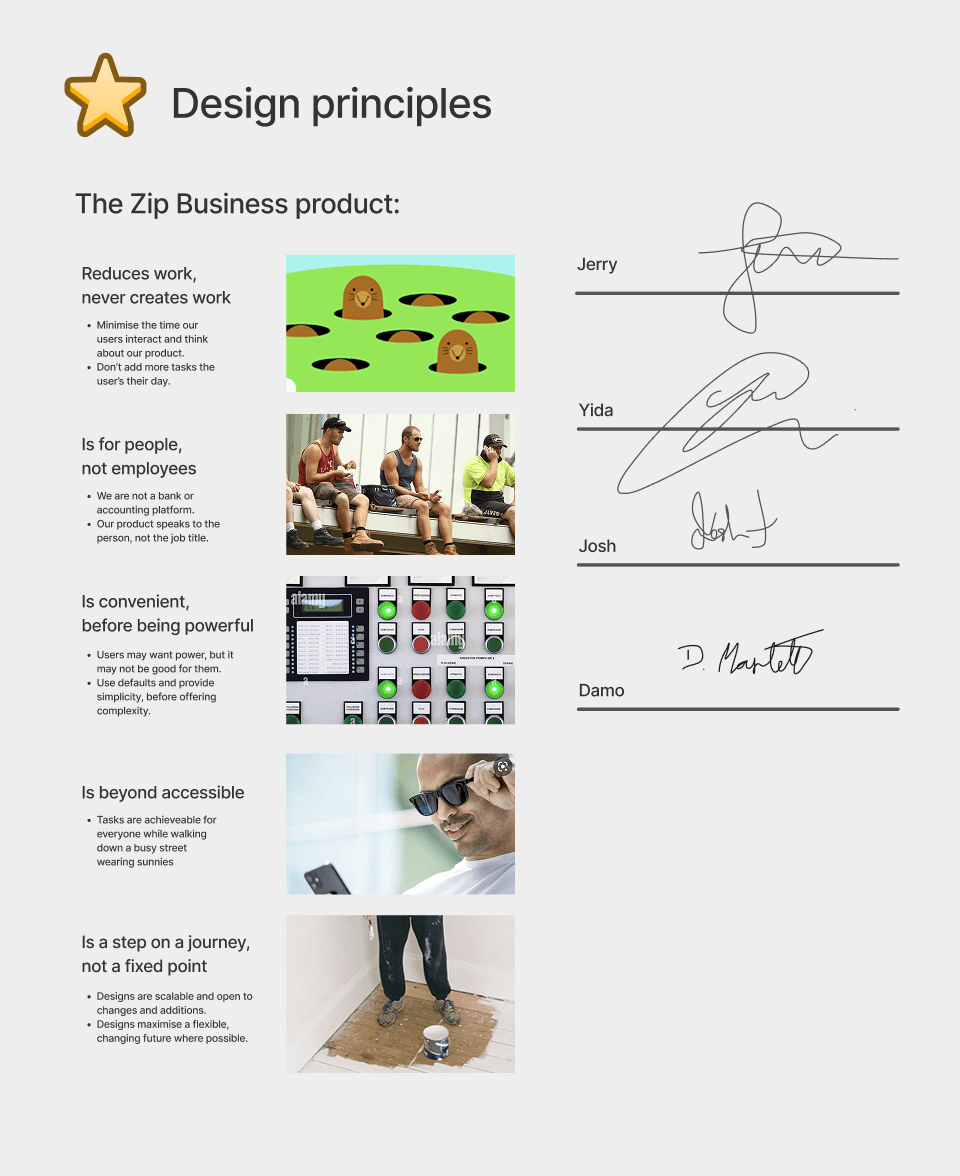

Businesses wanted clear guardrails, not rigid policy engines.

Owners needed confidence that spend was controlled, without micromanagement.

Teams expected modern card-based workflows, not invoice-style processes.

Value needed to be visible immediately to justify adoption.

Importantly, spend management was seen less as an accounting tool and more as a trust and control mechanism - enabling businesses to delegate spend safely and conveniently.

These insights reinforced a need for strong defaults, progressive disclosure, and organisation-first design.

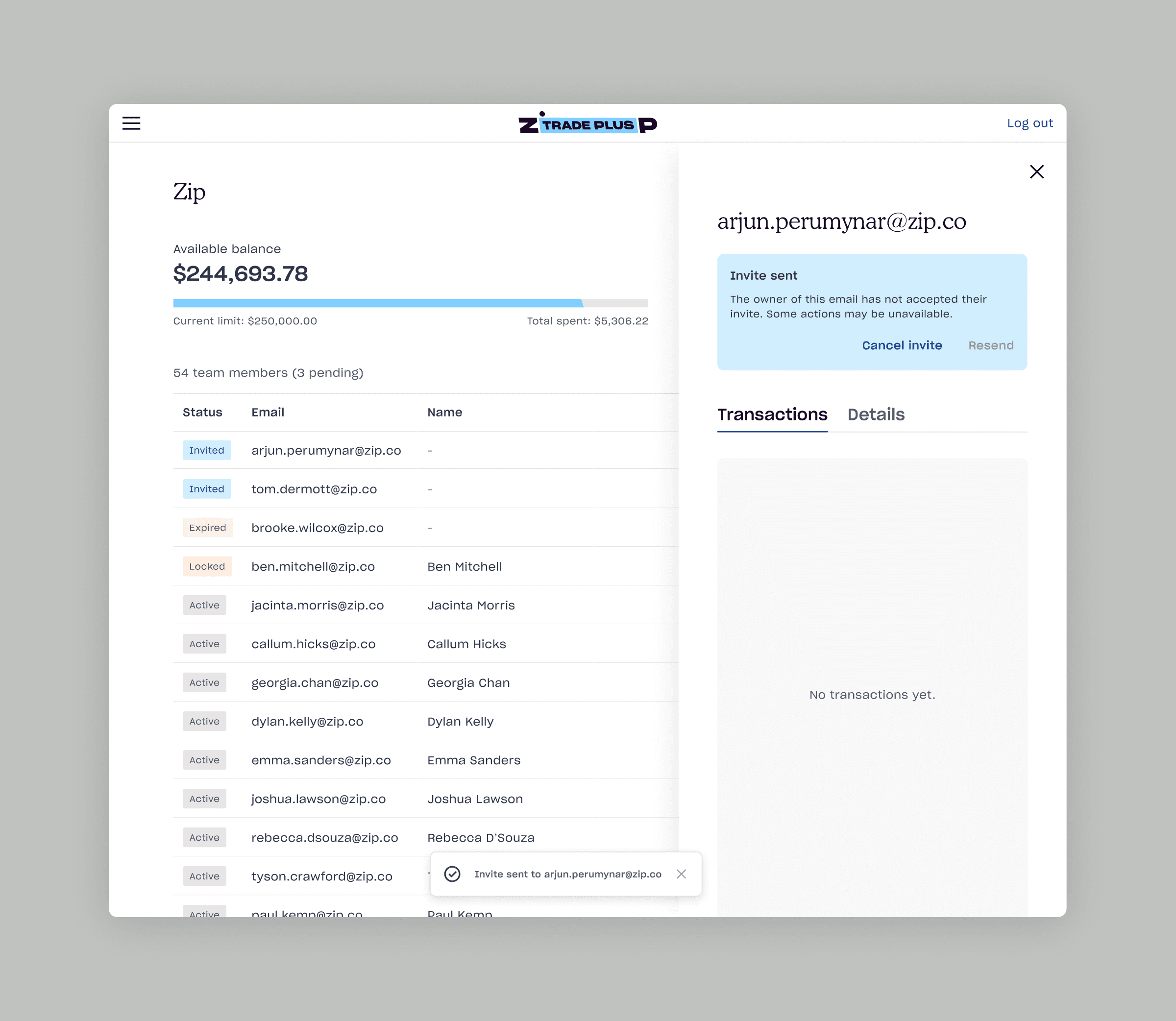

Phase 1 of a fully-fledged spend management platform built around organisational structure, cards, and controls was delivered with high confidence.

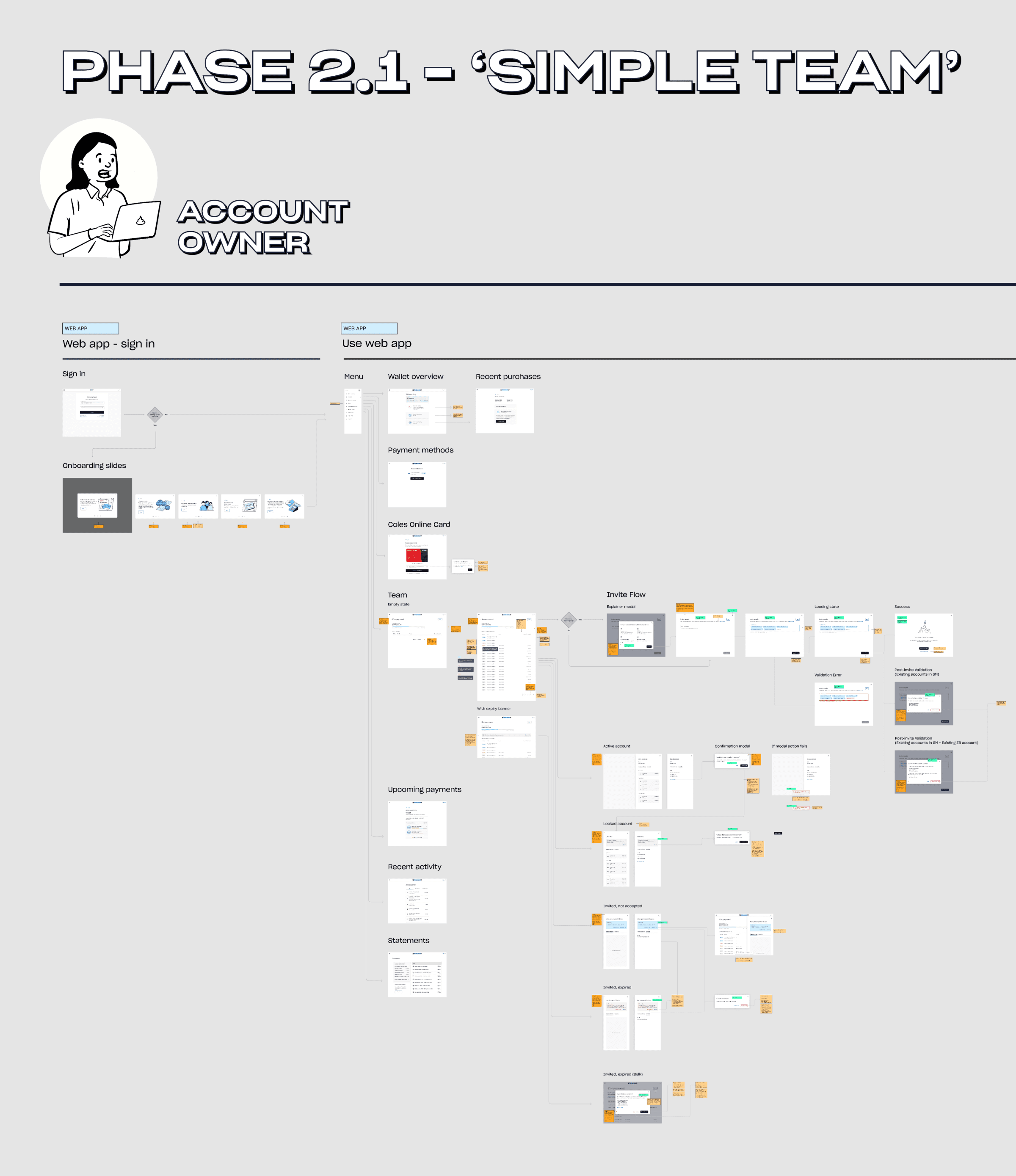

After delivering a robust roadmap towards a target spend management product, we commenced work on and delivered Phase 1 of the roadmap.

Phase 1 foundational work involved:

Introduction of a variation of our core pay later product to Coles B2B customers.

Credit limits up to $1M AUD.

Migration of Coles business accounts onto Zip Business.

Support for parent/child account structures.

This laid the groundwork for the rollout of spend management capabilities outlined and mapped to requirements for future phases.

Card issuance for every employee.

Spend controls by value, MCC, and spend velocity.

Omnichannel support (in-store and online).

Open-loop usage with no merchant restrictions.

Design work was also delivered on platform extensibility including:

Introduction of a Program concept for co-branding and top-level administration.

UX foundations for approvals, budgeting, and reporting.

Co-branded physical cards planned as a Phase 2 fast-follow.

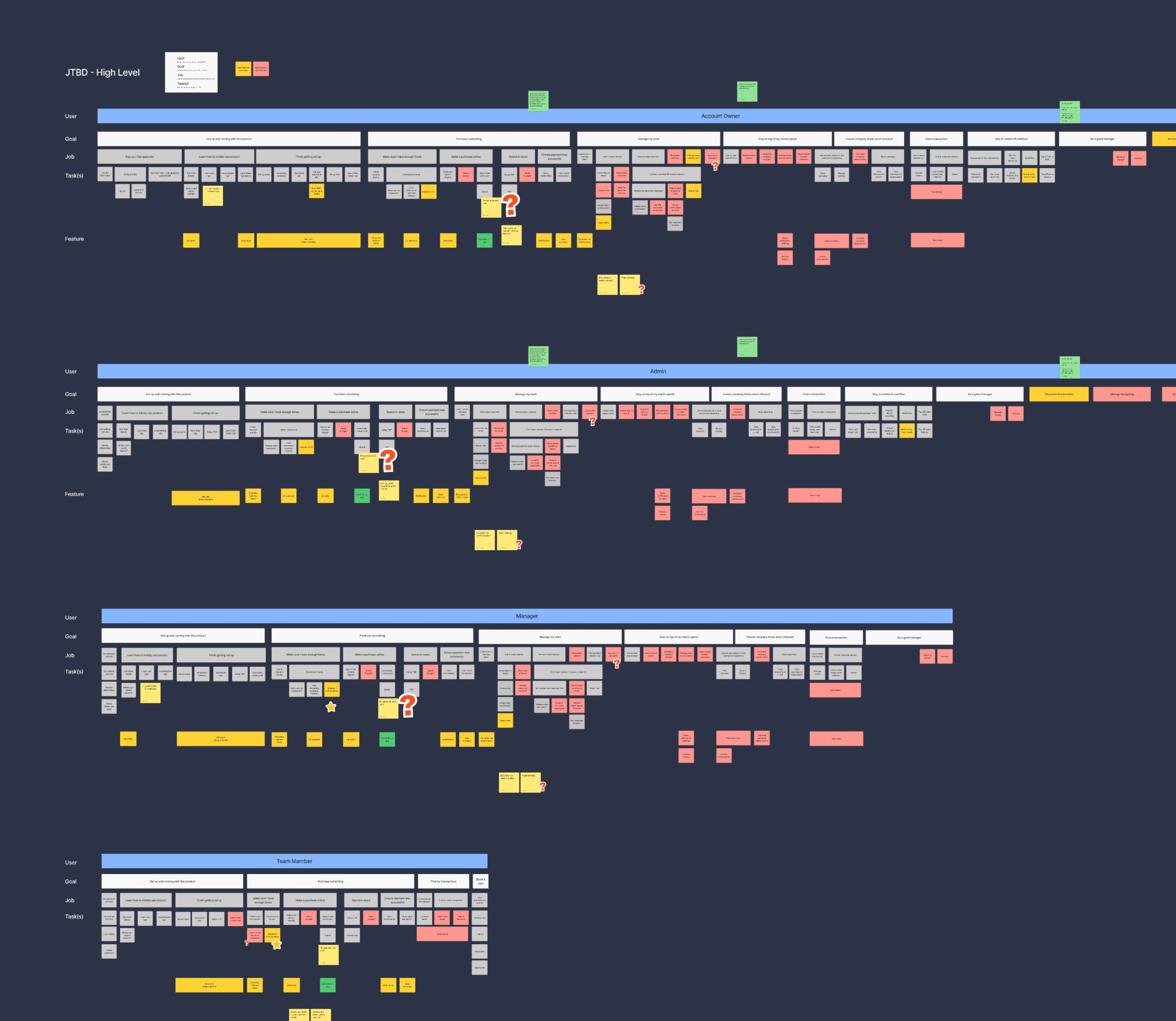

A comprehensive exploration of JTBD helped teams align on experience phases.

Each phase of the project was mapped to ensure the experience would scale along with its feature sets.

I lead a team of three designers, organizing them in a way to empower thinking on scalability of features.

Contract designers were brought on to bring designs and flows to bear within target deadlines. As a result, designs needed to be planned and co-ordinated to effectively scale design output and deliver screens and flows efficiently.

I chose to change the organization of the team such that each designer focused on a feature, rather than a phase. This empowered each designer to own the planning of individual features and exercise thinking in scaling them.

This led to high collaboration and shared understanding across the design team, and crucially maximized the product scalability.

Shared design principles.

Maintenance of expansive flows outlining each phase and user segment were crucial in keeping the team focussed and properly oriented.

UI surfaces were planned as components that would expand through successive phases. Often we were designing for 3 phases at a time.

Phase 1 of the platform was delivered to Coles Group’s specifications and validated internally as a scalable foundation for spend management at Zip.

The work:

Enabled Zip to credibly compete in the spend management category

Accelerated roadmap delivery via a launch-partner model

Aligned multiple teams around a shared platform direction

The requirement to support omni-channel spend (in-store and online).

Demonstrated how Zip could move beyond BNPL into daily business finance

Although the business unit was later shut down due to parent-company priorities, the platform design and system thinking remain transferable and relevant.

This project reinforced the importance of defining clear primitives early—organisation structure, cards, and controls—before expanding into advanced functionality.

It also underscored that external business decisions can change trajectories, but well-designed systems retain their value beyond any single outcome.

As part of the business unit shutdown, design also led the sequencing and experience of sunsetting customer-facing products. This included defining the order of discontinuation across multiple products, designing clear closure states, and crafting copy that balanced transparency, reassurance, and long-term clarity.

The work reinforced the importance of treating end-of-life experiences with the same care as launch moments—preserving trust, reducing confusion, and leaving users with a coherent final mental model of the product.